By Rockefeller Philanthropy Advisors | November 25, 2021

The Covid-19 pandemic which has caused unexpected panic and disruptions is still considered a big threat both for public and private sectors. While there have been more than enough damages to the health of the people, the economic implications are very overwhelming, especially for businesses. For Micro, Small and Medium Enterprises (MSMEs) in Nigeria, there has been huge disruptions with many of the businesses struggling with finances and battling with operational challenges.

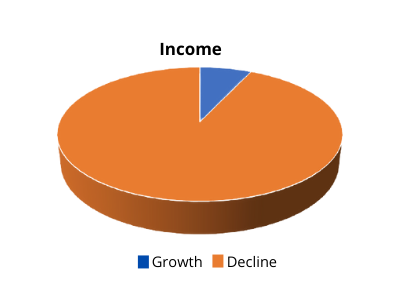

According to Government Enterprise and Empowerment Programme (GEEP) Covid-19 impact survey, majority (80%) of small businesses reported decline in income because of the pandemic.

This result is similar to the findings of the Enterprise Development Centre’s survey which reported that majority (93%) of small businesses in Nigeria reported decline in income. About (91%) reported a worsening financial situation with most of the respondents, expressing concerns on their inability to work or earn an income.

The critical challenges generated by the pandemic has forced these small businesses to adopt different crisis management and business response measures aimed at navigating the period. In practical terms, the measures have proven to have assisted businesses to survive.

The following are the top coping mechanisms that small businesses are using to forge ahead:

Savings

According to GEEP study, savings were a critical coping measure adopted by small businesses. Majority (90%) of the businesses are using the money they had saved to cater for some of their operations and also take care of their household needs. Small business owners and managers realized that utilizing their financial resources judiciously is an important way of surviving during crisis period. A small proportion used more drastic measures like selling of assets or borrowing.

Investment

Another coping mechanism for most businesses is that they have reduced household or business investments at the moment. Unlike in the past where some business owners try to look out for any investment opportunity, the Covid-19 era has ushered careful consideration of options before any investment. This mechanism which is expected to be temporarily is expected to help the businesses stabilize to the point that they can resume investments.

Borrowing

Small businesses have used borrowing as a coping mechanism to navigate the period. As most small businesses did not obtain external funds, they relied more on internal funds through borrowings from friends and family and cooperatives to run their enterprises.

Collaboration/Partnerships

Small businesses are also seeing value in collaboration and partnerships. Collaboration has proven to be a powerful tool for small businesses. MSMEs are leveraging connections with each other to generate and execute ideas that are helping them achieve common goals and help their businesses grow. This is seen in an increased number of collaborations among small businesses in the country recently.

The post-Covid-19 period will likely continue to present changes in the operations of small businesses. Small business leaders apart from other innovative approaches towards surviving, must continue to utilize savings, reduce investments, borrow reasonably and also collaborate/partner.

TAGS: