By Rockefeller Philanthropy Advisors | January 31, 2022

Loan repayment which is a way of paying off the debt balance on a loan over an agreed period has been a major issue in small business finance. Repayment can be in a lump sum with interest at maturity of a loan. On the other hand, loan repayment defaults are when a borrower could not or will not pay back his or her loan and when the financial institution no longer expects to be repaid. There have been reports of loan repayment defaults for both large corporations and small businesses. This has necessitated discourses on how loan repayment can be enhanced at all levels.

It is usually argued that businesses that receive larger amounts of loan disbursements are closely monitored by top management of financial institutions. This is to ensure that the borrowers utilize the disbursements appropriately and for the financial institutions to recover their funds and maintain a healthy financial balance sheet. In most cases, these borrowers are less likely to default in repayment since they are able to use the funds, ex-post, for its intended purpose. On the other hand, businesses that receive smaller amounts of loans often complain that the amounts may not be sufficient for their business needs or implementation of a particular project thereby creating additional uncertainties to its cash flows and sometimes making the businesses unable to repay at the appropriate time. As a result of these, researchers argue that the larger the loan size, the higher the repayment performance.

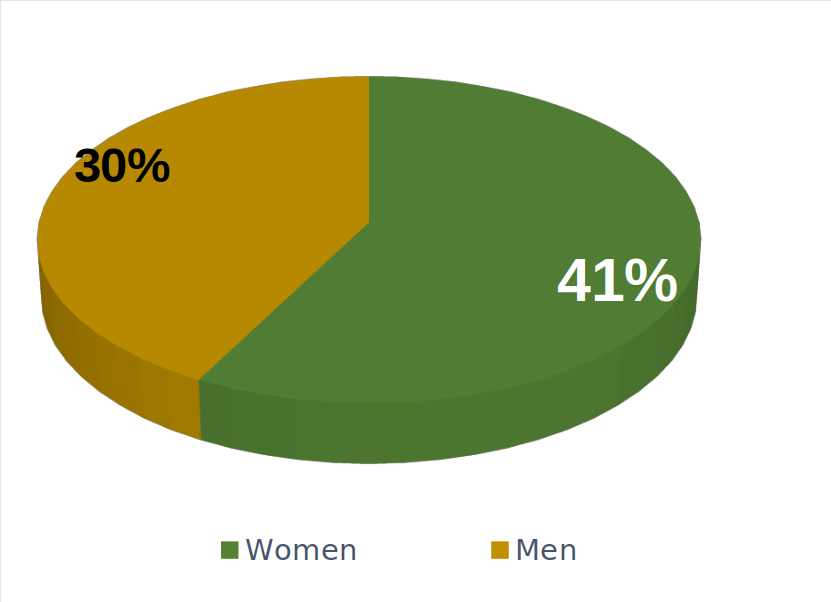

There have been initial hypotheses about women being more likely to go hungry or to see a negative impact on business than men after the Covid-19 lockdown, there are less variance in the data across gender. Data from the Government Enterprise and Empowerment Program (GEEP) shows some differences in loan payments and management. From the survey, women are more likely to see their loan repayments as a burden. This is because 40% of women reported that they see their loans as a ‘heavy burden’ as against 31% of men who reported. This finding is consistent with the previous notion that women are more concerned with loan repayments than men.

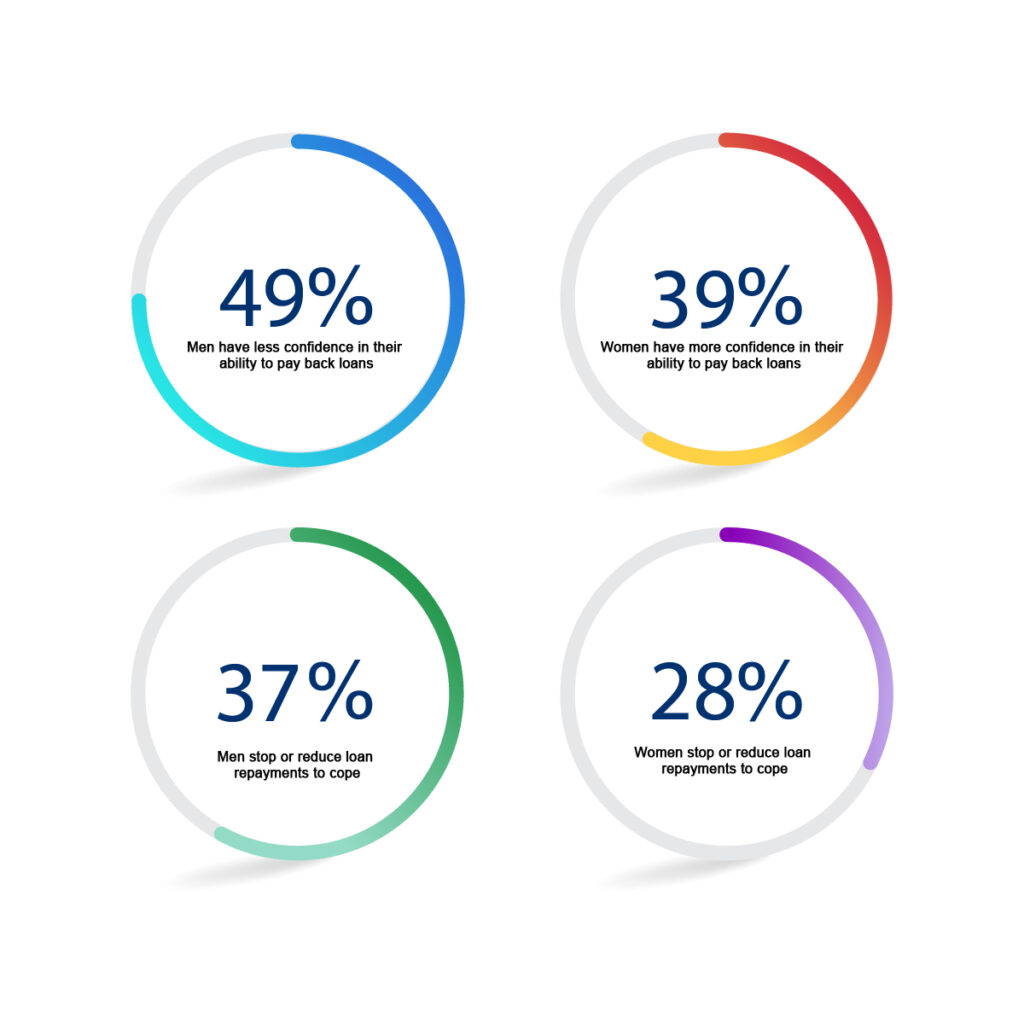

In essence, women are said to be more worried about their loan obligations than men. Most men who are borrowers do not necessarily consider their loan repayment as a major concern apart from the consciousness that they will need to pay back. In terms of confidence in the ability to pay back loans, men (49%) have less confidence in their ability to pay back loans than women (39%). As such most women strongly believe that they will be able to pay back their loans. However, women are less likely to report stopping or reducing loan repayments to cope. This is according to the GEEP survey which had 37% for men and % for women.

In essence, women are said to be more worried about their loan obligations than men. Most men who are borrowers do not necessarily consider their loan repayment as a major concern apart from the consciousness that they will need to pay back. In terms of confidence in the ability to pay back loans, men (49%) have less confidence in their ability to pay back loans than women (39%). As such most women strongly believe that they will be able to pay back their loans. However, women are less likely to report stopping or reducing loan repayments to cope. This is according to the GEEP survey which had 37% for men and % for women.

Many reasons have been adduced as to why small businesses fail to repay their loans. These include the inherent characteristics of borrowers/businesses; characteristics of the lending/financial institution and the suitability of the loan product to the borrower; and the systematic risk from the external factors including political, economic, and business environment and market conditions. Each of these factors could make it unlikely that the loan would be repaid.

The implications in most cases are that the borrowers have bad credit history, and the lending institutions may not have enough funds to extend to other customers. In most cases, before any loan is approved, the credit history of the borrower/business is requested. Bad credit history could mean that loan application may not be considered. Lending institutions have also cited loan defaults as a major reason why they are skeptical in considering loan requests for some small businesses.

What lending Institutions and Government Need to do

In reducing the occurrences of loan defaults, experts suggest that lending/financial institutions should be more deliberate in considering loan size, loan tenure, interest rate, and most importantly borrower’s attitudes when giving loans to small businesses. Hence, the need for small business owners to maintain clean credit history. In improving small business owners’ loan repayment capacity, there is the need for the government to introduce policies aimed at increasing loan sizes that could enhance the business owners’ access to basic business requirements and improved business management. Effective loan management could engender productivity, higher income, and reduced per-unit cost for those into production. This could also lead to a better standard of living and improved welfare for the households.

What SMEs Need to do

SMEs on their part must be careful in determining loan sizes and must be disciplined enough in loan management. The loan size must be commensurate with the needs of the business. In some cases, SMEs divert loans meant for specific needs/projects to other needs including household issues. Studies have found that lack of need for achievement in business and diversion of loan funds influence SME owners to default on their loans. In essence, there must be strict compliance with the loan terms and conditions. SMEs should be able to utilize the disbursements for the intended purposes and closely monitor their performance. A key consideration is that the SME owners must also learn how to put their profits back into the business to improve their operations. In ensuring that SME owners and managers manage their loans effectively, there is the need for SMEs to participate in information sessions organized by financial institutions. SME owners and managers are also encouraged to seek professional advice from their respective account officers at their banks or designated SME desk at the banks.